Health Insurance Guide

Expert insights and comprehensive guides to navigate healthcare coverage

Trending Articles

The Truth About Why Health Insurance Costs So Much in America

Americans pay more for healthcare than any other developed nation - but why? This investigative deep-dive reveals the 10 biggest factors driving up your premiums, from the 30% administrative overhead to pharmaceutical pricing games. Discover how hospital consolidation, surprise billing, and the middleman economy add thousands to your annual costs. Most importantly, learn practical strategies to reduce your expenses despite the broken system.

Warning: The Latest Health Insurance Scams Targeting Americans

Scammers are getting sophisticated, using AI and stolen data to create convincing health insurance fraud schemes. This urgent guide exposes the newest tactics including fake ACA websites, robocall scams, and phishing attacks targeting Medicare recipients. Learn the red flags that always indicate fraud, how to verify legitimate insurance agents, and what to do if you've already been targeted. Includes a scam-checker checklist and resources for reporting fraud.

Latest Guides

How Does Health Insurance Work? Everything You Need to Know in 2025

Demystifying health insurance once and for all. This guide explains the entire system in plain English - from how premiums, deductibles, and copays actually work together, to understanding the difference between PPO, HMO, and EPO plans. Learn how insurance companies negotiate rates, why in-network matters, and how to calculate your real out-of-pocket costs. Perfect for first-time buyers or anyone confused by their coverage.

How to Get Health Insurance Without a Job, Employer, or SSN

Lost your job? Self-employed? New to the US? You still have options for quality health coverage. This guide covers every pathway to insurance for non-traditional situations - from ACA marketplace plans and Medicaid to short-term coverage and health sharing ministries. Special sections for undocumented immigrants, visa holders, and those between jobs. Includes state-specific programs and little-known assistance options that could save you thousands.

The Self-Employed Guide to Health Insurance: Save Money, Get Covered

Being your own boss shouldn't mean going without health insurance. This comprehensive guide shows freelancers, contractors, and small business owners how to navigate the insurance maze. Learn about the self-employed health insurance deduction that could save you thousands, compare individual vs. group plans, and discover when an HSA makes sense. Real examples from successful entrepreneurs show exactly how they structured their coverage for maximum protection and tax benefits.

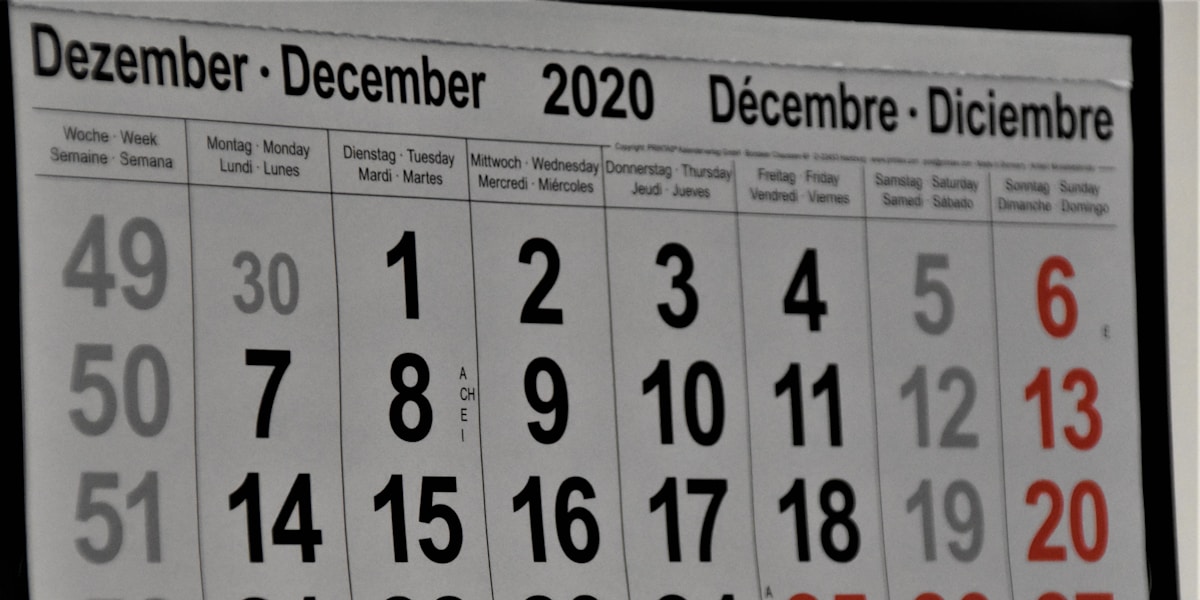

2026 Open Enrollment: Everything You Need to Know Now

Get ahead of the 2026 enrollment period with this early-bird guide. While dates aren't final, we break down expected timelines, predicted premium changes, and new regulations coming into effect. Learn why starting your research now could save you from costly mistakes later. Includes preparation checklists, documents you'll need, and strategies for comparing plans effectively. Plus, special enrollment periods you might qualify for if you miss the main window.

2025 Open Enrollment Complete Guide: Don't Miss Your Window

The 2025 enrollment period is here - make sure you're ready. This time-sensitive guide covers exact dates for marketplace, Medicare, and employer plans. Learn the critical differences between each enrollment period and what happens if you miss them. We explain qualifying life events, special enrollment rules, and backup options. Includes action plans for different scenarios and tips for avoiding the December rush when systems crash and call wait times explode.

How to Deduct Health Insurance on Your Taxes: 2025 Complete Guide

Turn your health insurance premiums into tax savings with this comprehensive guide. We break down exactly who can deduct premiums (spoiler: more people than you think), how to calculate your deduction, and strategies that could save you thousands. Special focus on self-employed deductions, HSA contributions, and itemized medical expenses. Includes worksheets, real examples, and warnings about common mistakes that trigger audits.

Getting Insurance to Cover Breast Reduction: What You Need to Know

Breast reduction surgery can be life-changing, but will insurance pay? This detailed guide walks you through the entire approval process, from documenting medical necessity to appealing denials. Learn exactly what symptoms and documentation insurance companies require, which providers are most likely to approve, and how to work with your doctor to build a strong case. Includes real patient stories, average costs, and alternative financing options if insurance says no.

Dental Implants and Insurance: How to Get Coverage in 2025

Dental implants can cost $3,000-$6,000 per tooth, but insurance might help more than you think. This guide reveals when medical insurance (not just dental) might cover implants, including after accidents, birth defects, or cancer treatment. Learn the critical difference between cosmetic and medically necessary procedures, how to coordinate medical and dental benefits, and financing strategies that make implants affordable. Includes sample appeal letters and success stories.

Ready to Find Your Perfect Health Insurance Plan?

Our licensed advisors are here to help you understand your options and find coverage that fits your needs and budget.

Get Your Free QuoteReady to Secure Your Coverage Today?

Join thousands who have found their perfect health insurance plan with Health Insurance Network. Get your personalized quote in seconds.

Free quotes • No obligations • Instant results